Superior policy management system is the key to meet customer expectations, achieving market growth and operational efficiency goals. Getting insurance for a new vehicle instantly is virtually impossible, which otherwise takes a couple of hours /days to generate a policy document manually. Our solution to this long-standing challenge is NSURE POS, which generates online electronic policy. NSURE POS from KGiSL is an insurance policy management software specifically designed to cater the needs of general insurance companies

NSURE POS is a fully integrated web-based insurance policy management system, which enables the end users (customers & agents) to generate online policies based on parameters set in underwriting guidelines.

It has seamlessly integrated modules of underwriting, policy administration and detariffication rule engine for Insurance Point of Sale. It is easily integrated with advanced application components such as fully connected portals, mobile applications, product configurator, dynamic reporting capabilities & printing solution.

Our insurance policy administration system provides underwriters, brokers, sales, and service agents with an integrated view of customer and account information that dramatically improves productivity and customer service and presents opportunities for up-sell and cross-sell.

Being used by more than 10,000 insurance agents across Malaysia

99.9% UPTIME of the software and the servers since inception (2005)

Web-based application and 3-tier architecture platform

Compliance with regulatory requirements

Our policy administration systems give organizations a competitive edge with the following benefits

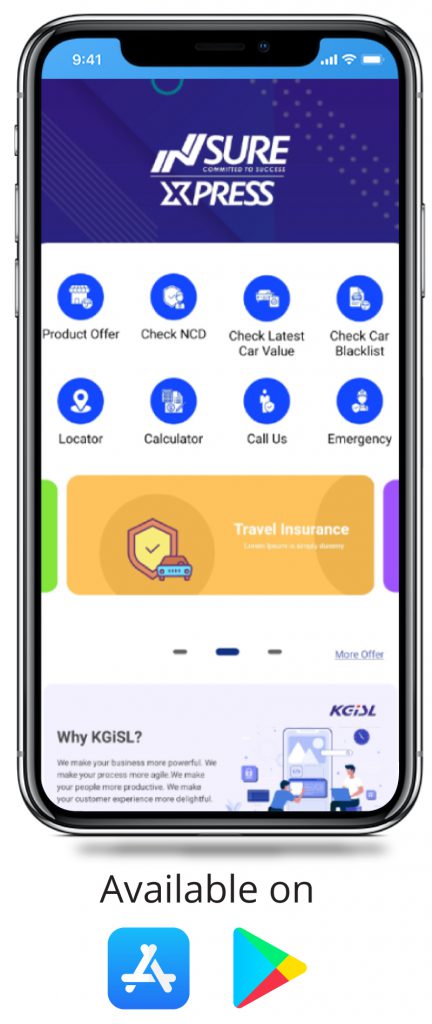

NSURE POS mobile allows agents and users move digital and have on-the-go access to the policy details. Users can purchase, renew, view, past/current policy information, whereas agents can track and monitor customer policy requests and details on a real time basis using the mobile app. The insurance policy administration app eliminates the need for physical form filling and helps agents in improving productivity by faster closure of requests.

NSURE POS is packed with plenty of user-friendly features for Clients, Agents, Managers and Marketers. The app includes both common features & role-based privileged features

My client – 360 degree view

OCR for card reading

Finger print authentication

Digital signature capture

eKYC viz face recognition

Google maps integration for location finder

Customer pay link

Image and document upload