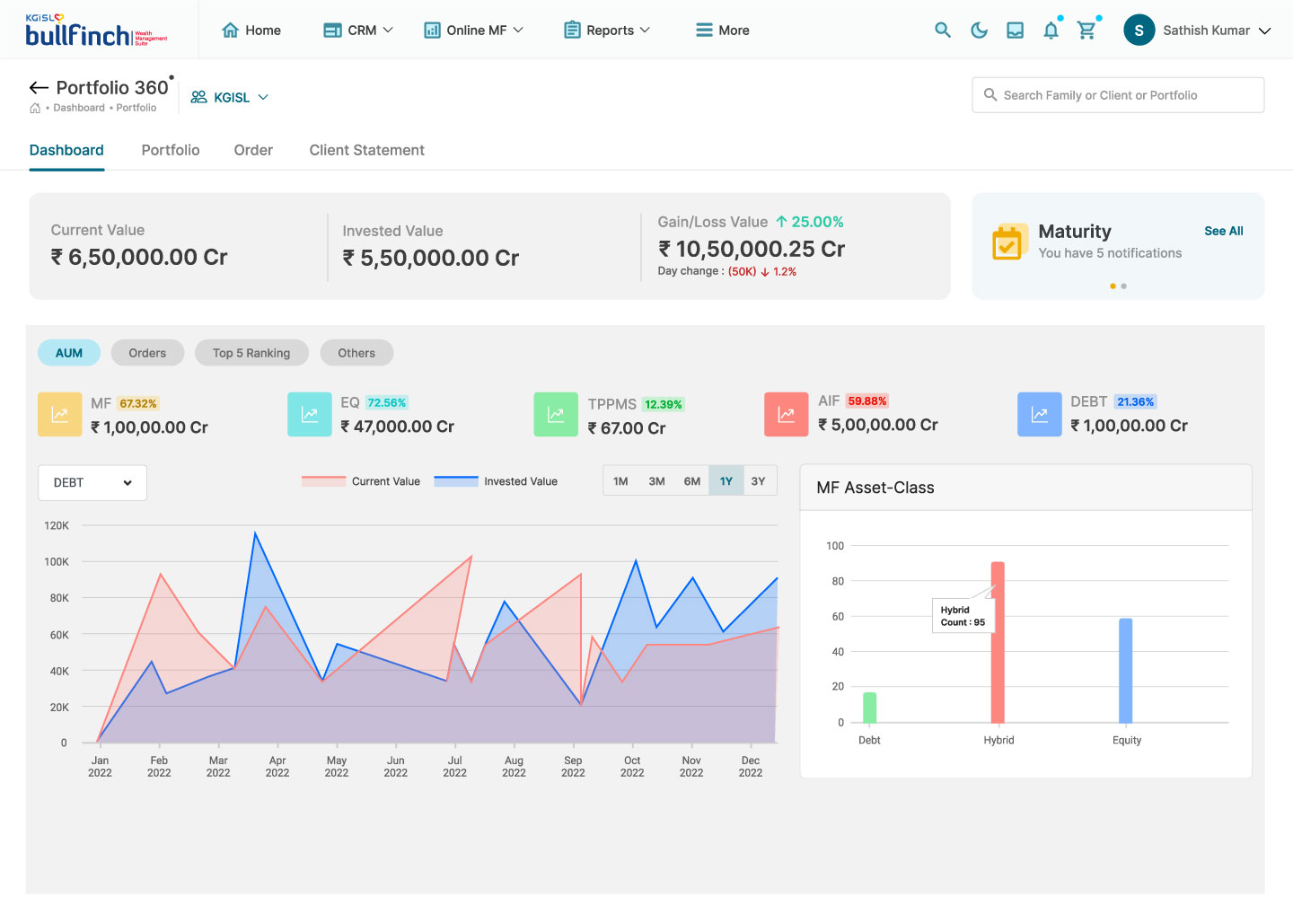

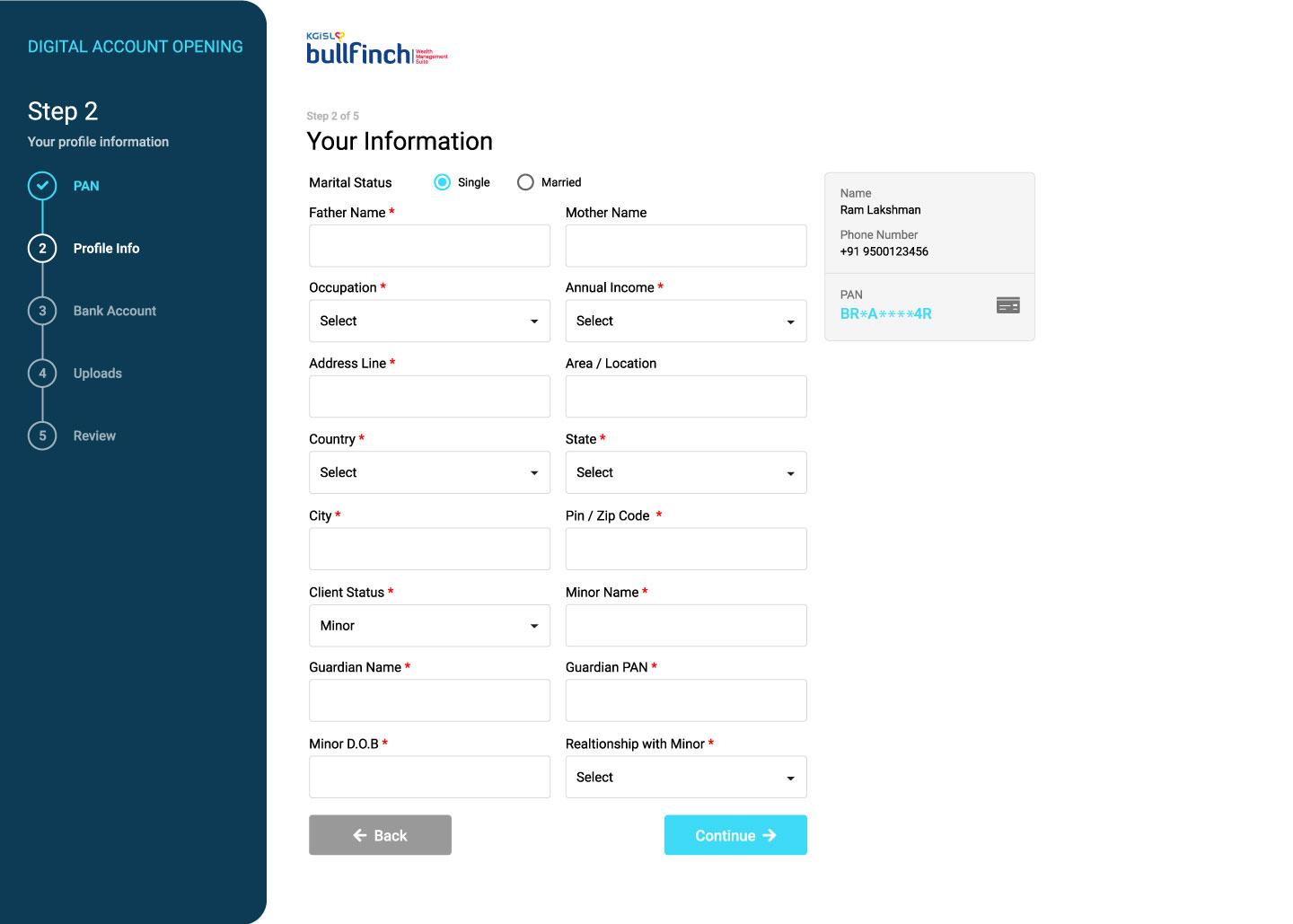

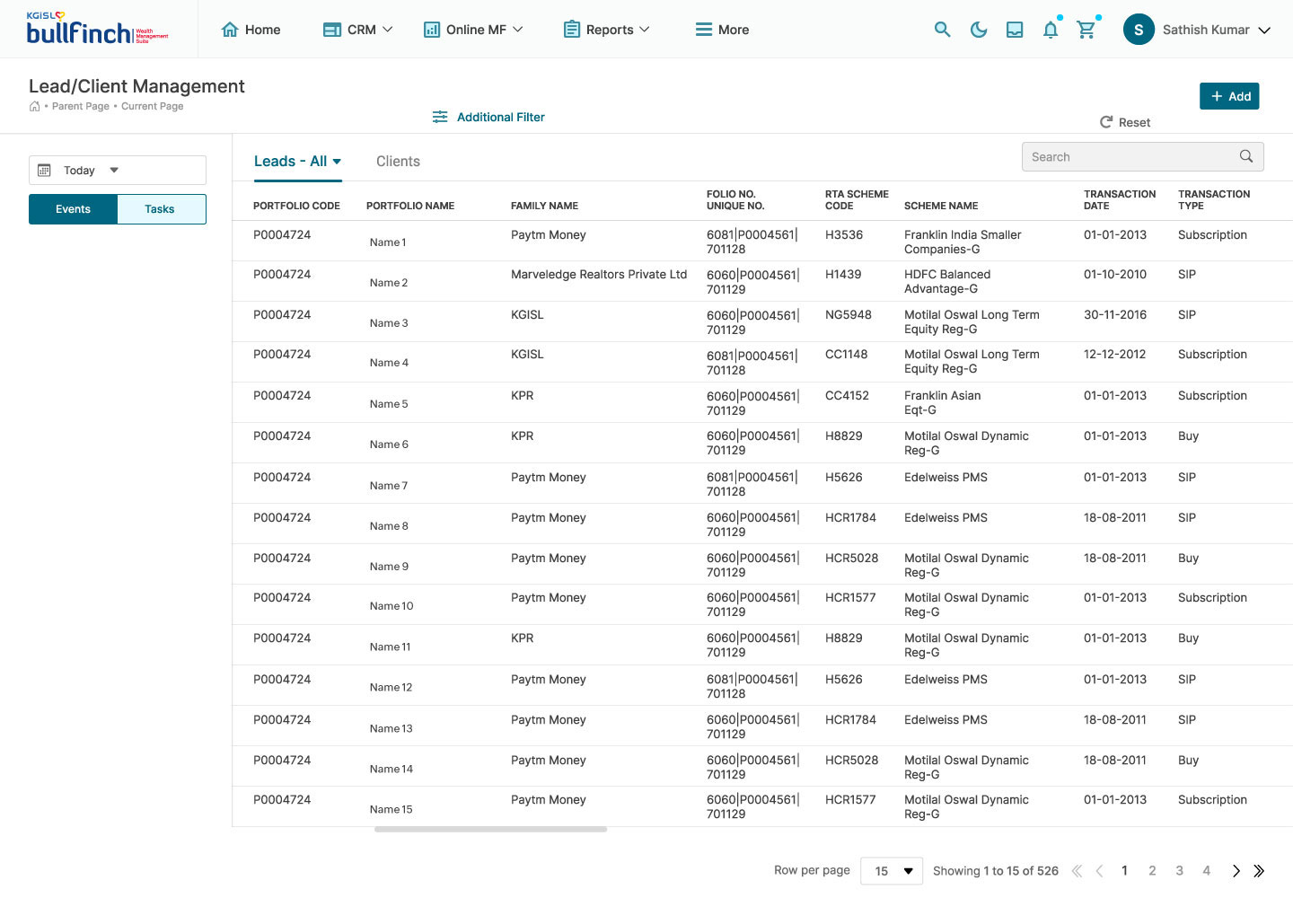

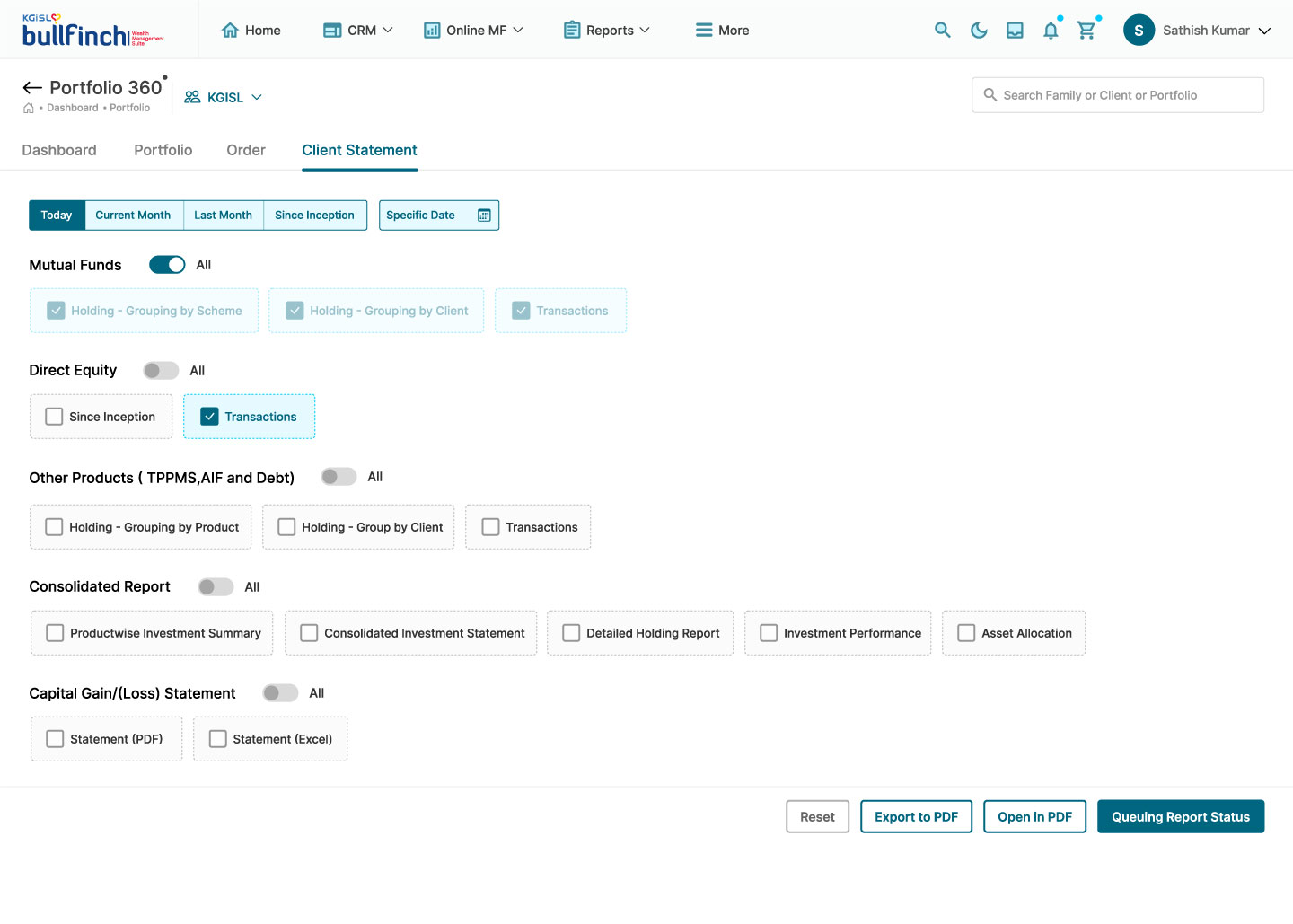

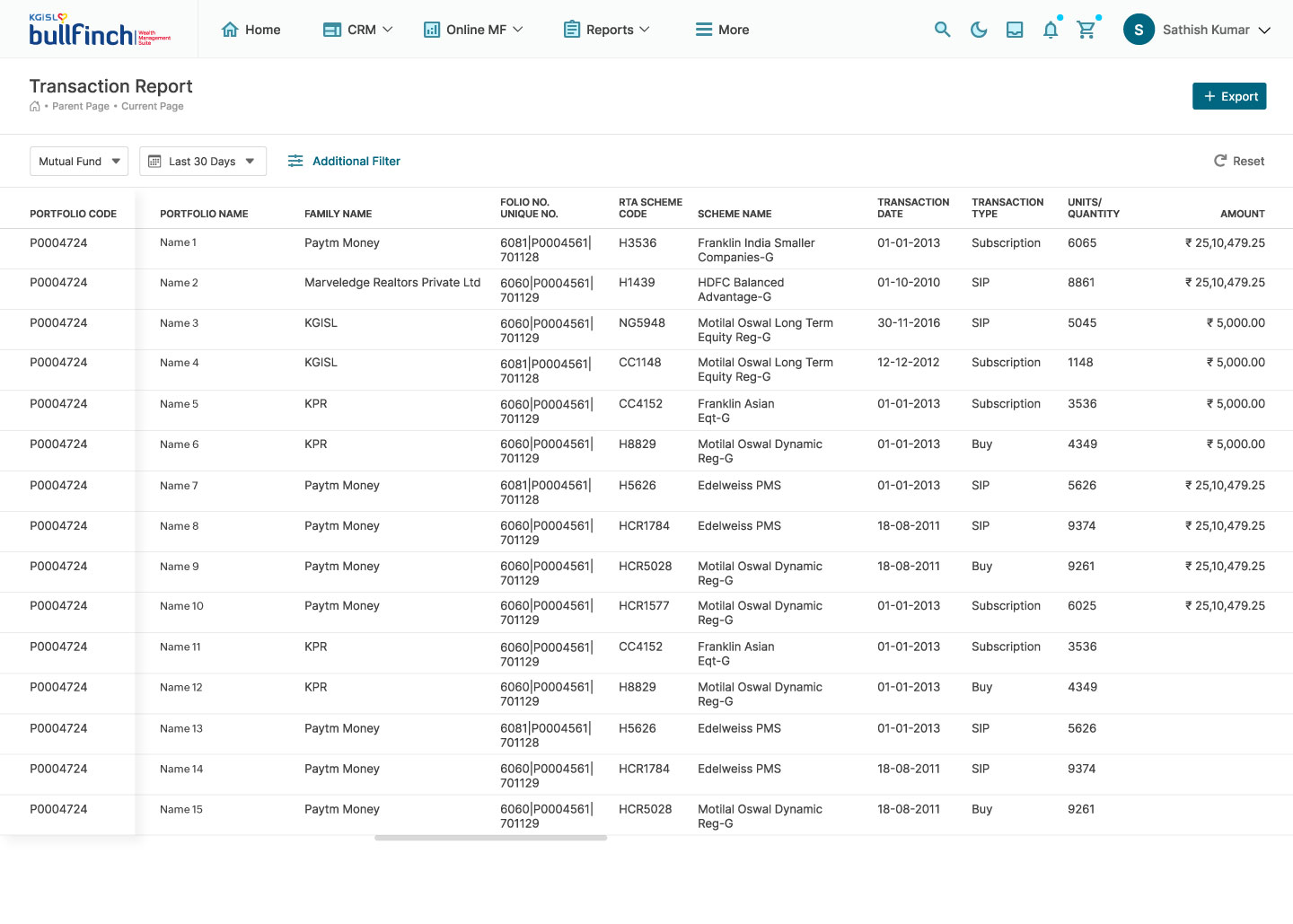

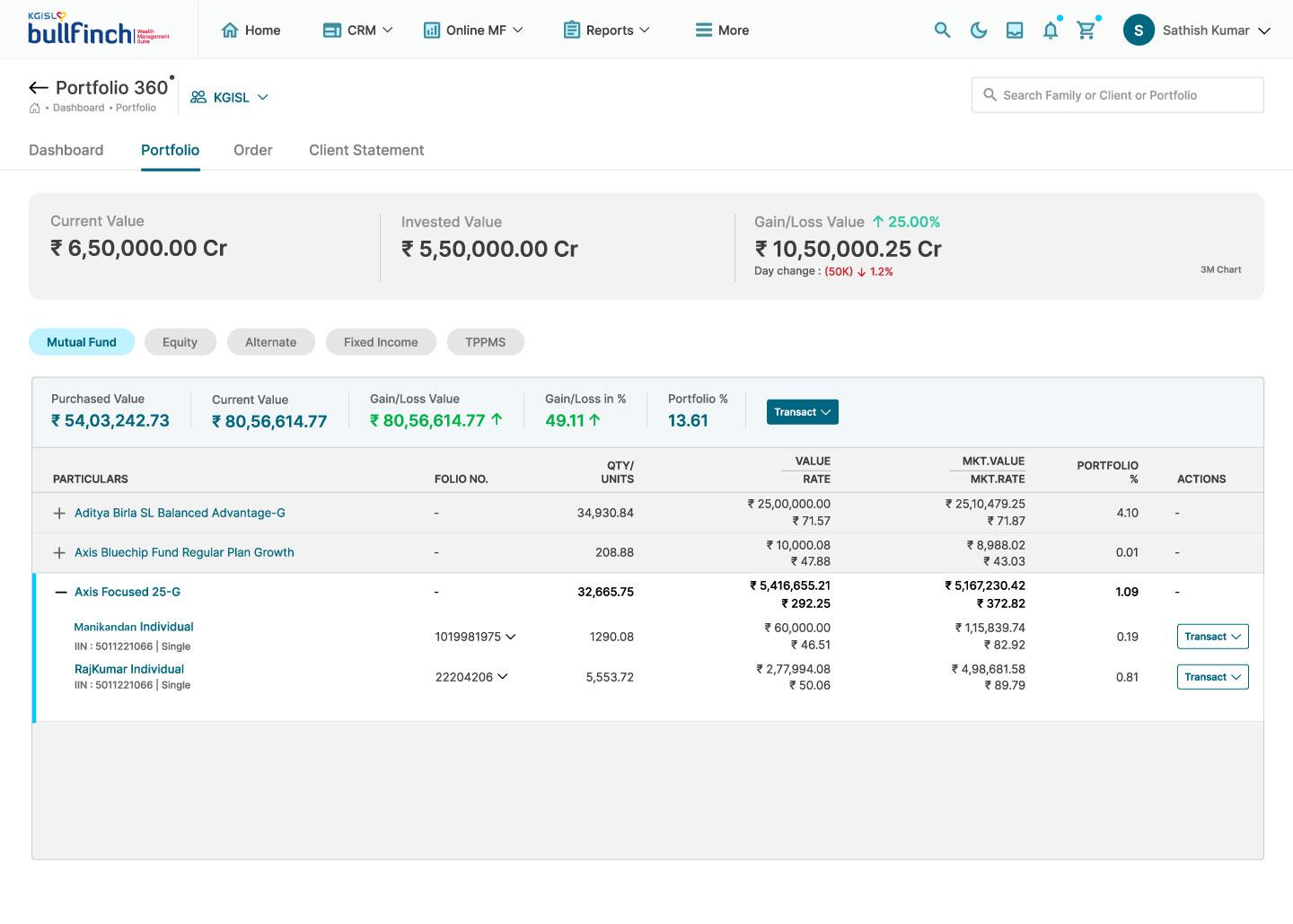

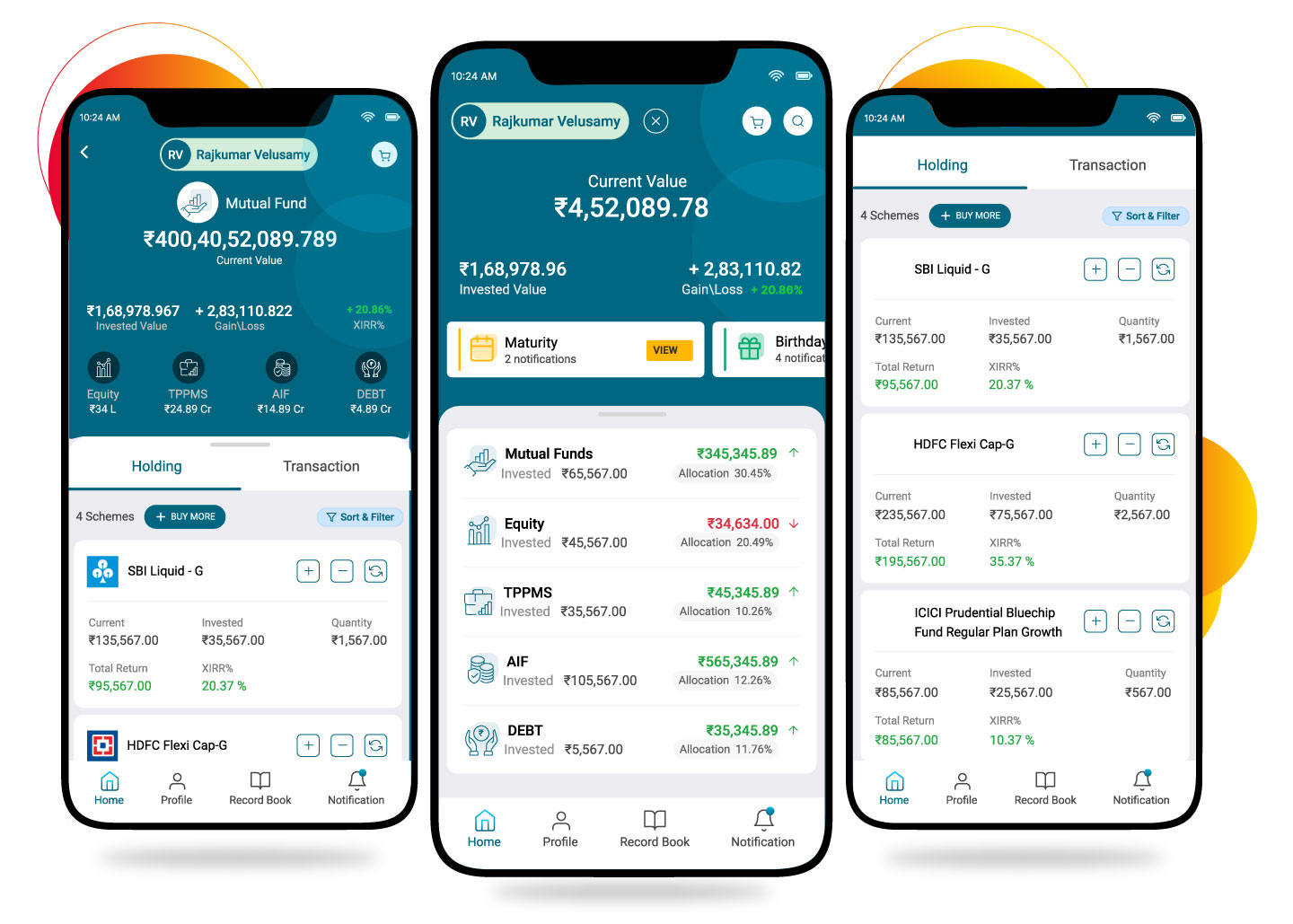

Bullfinch Wealth Suite is a SaaS-enabled, integrated, front-to-back Omni channel system that includes diversified range of asset classes to manage the complete wealth management lifecycle.

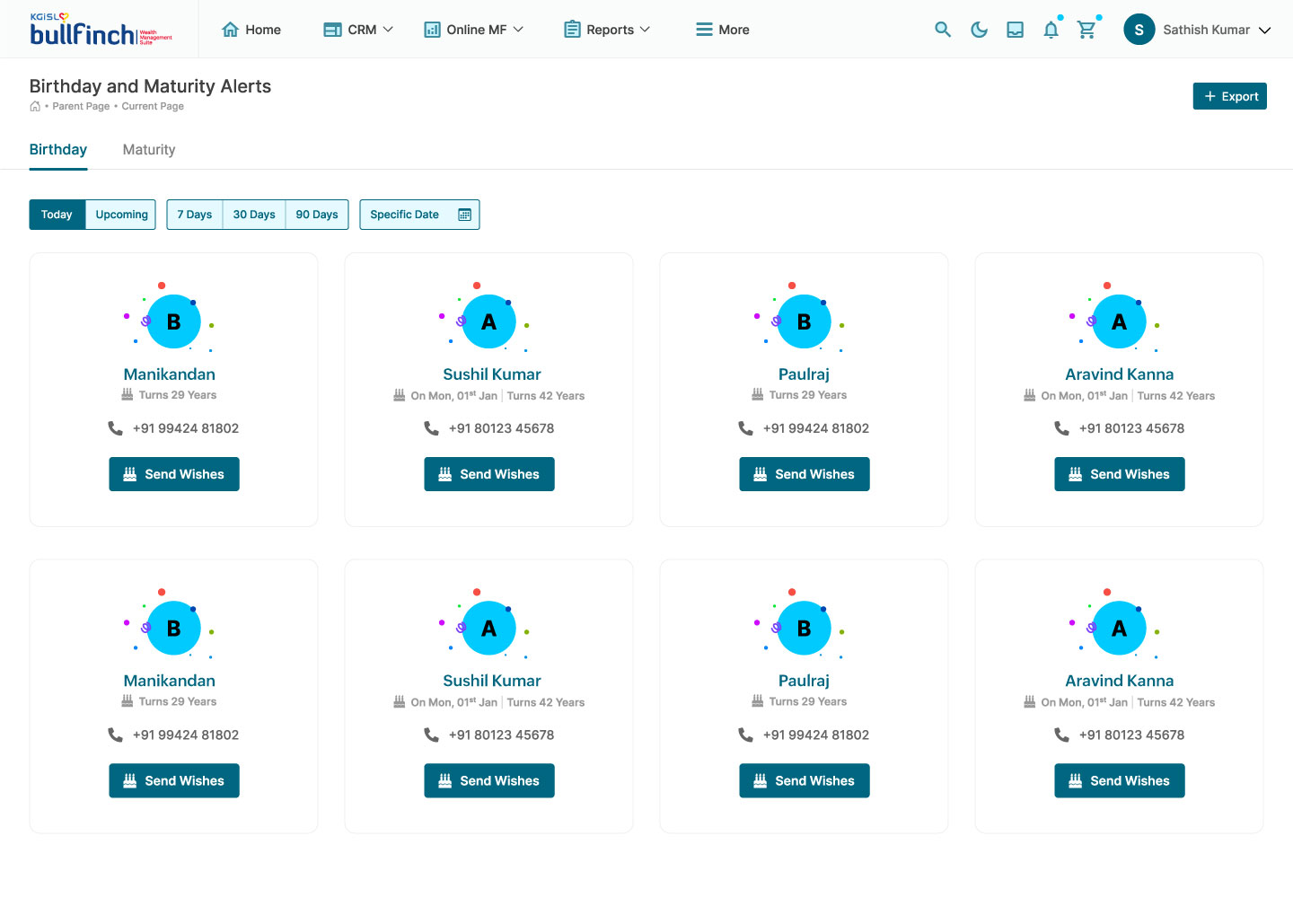

Bullfinch helps to unlock the insights and gets you on an exponential growth trajectory through its advanced analytics and personalized recommendations.

It serves all client segments from retail to high net-worth investors and fully supports the provision of discretionary and non-discretionary, advisory services from a single platform.